| First, consider the method loom.cc uses for accounting. When you purchase a gizmo, you don't stuff the money into the pocket of the cashier. You don't stuff directly into the cassa either. You place it to a shared drop point where she can pick it up (you can even take it back until she moves it to a place unaccessible to you). In the physical world. the choice for shared-drop-point place is rather limited. However, in the domain of numbers (codes, passphrases, whatever you call them), the space is unthinkably large. |

|

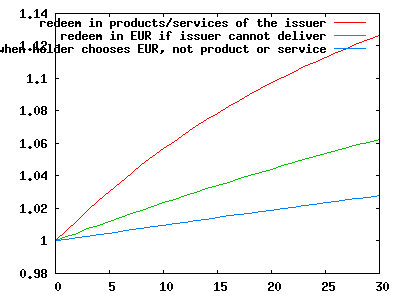

| An individual or business can make a written obligation, a contract that can be enforced in court. If anyone is interested to receive the offered service or product, being owed to has a value, and passing this on to someone else is equivalent to payment. If it is actually used for payments we call it money. How can he write the contract to make it appeal to hold it ? For obvious reasons, the potential buyers of the issuer's products / services are most likely to buy and hold his tokens. |

| To understand how CONVERTIBILITY works, consider this example: This guy just filled the tank on a gas station in Finland. The gas station only accepts EUR (EUR created by Euro banks), but the beer-belly guy has no EUR at all. He came from Sweden, he only has SEK created by Swedish banks. So he exchanges his SEK to EUR on the currency market so he can pay. Using electronic transactions, this is completed in a second. Conclusions: |

|

|

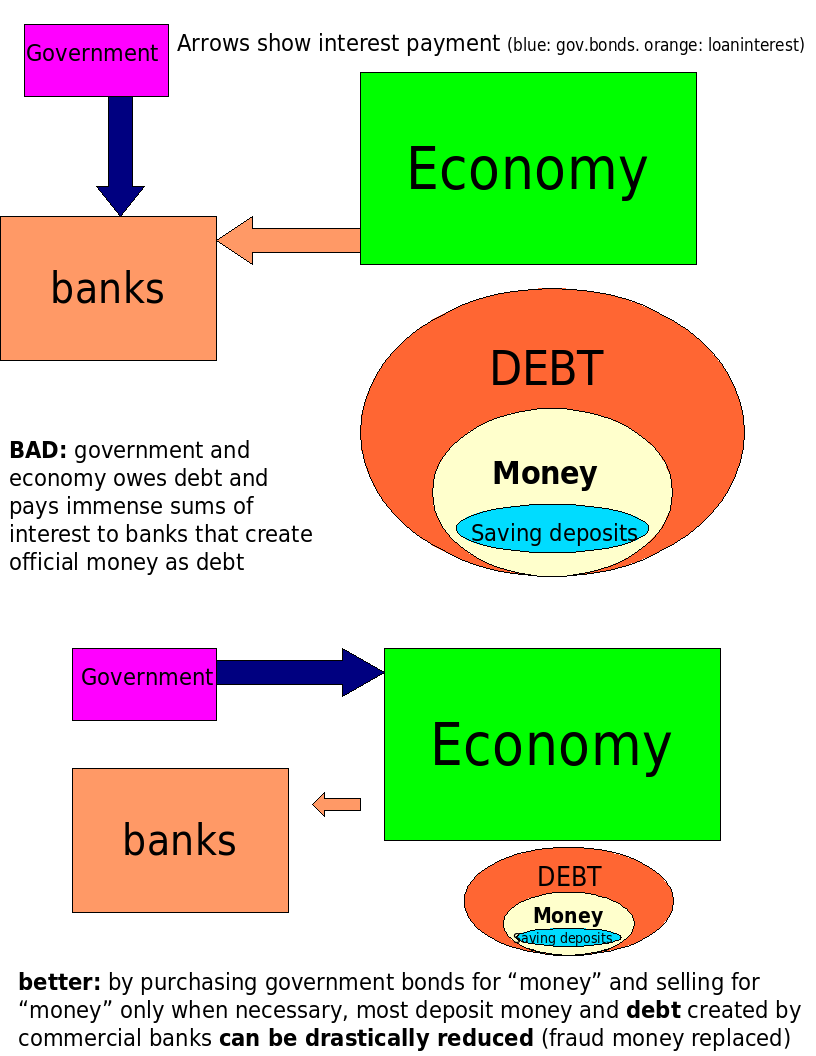

| Replacing part of the money supply by government issued bonds |